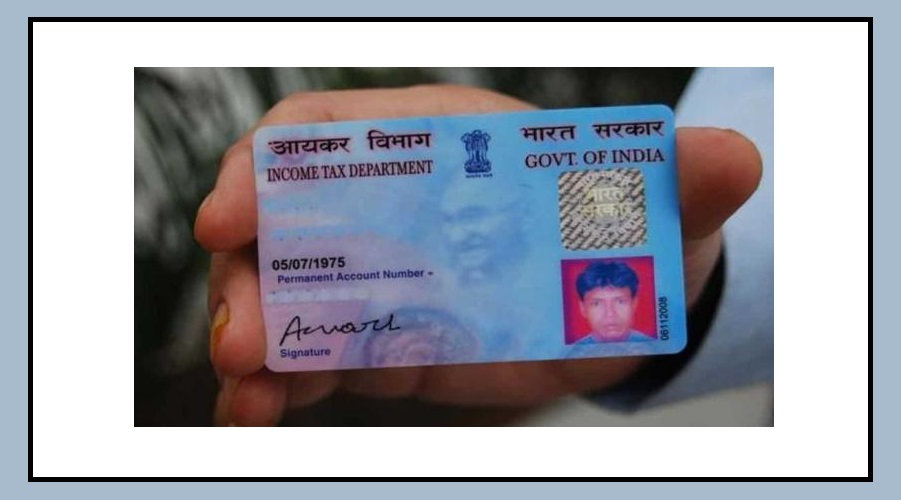

If you think not linking your PAN with Aadhaar is just a small mistake, think again.

The Draft Income-tax Rules, 2026 make it clear that the consequences are serious.

From blocked refunds to higher tax deductions, an inoperative PAN can directly affect your money.

The new draft rules, framed under the Income-tax Act, 2025, don’t change the system completely — but they clearly spell out the penalties.

And the message is simple: ignoring PAN-Aadhaar linking is no longer risk-free.

Contents

What Happens If Your PAN Becomes Inoperative?

If you are required to link your Aadhaar with PAN but fail to do so, your PAN will become inoperative.

Once that happens, three major things follow:

Your tax refund will be blocked.

You will not get interest on the delayed refund.

Higher TDS or TCS will be deducted.

This means even if extra tax has already been deducted from your salary or income, you will not receive the refund until your PAN becomes active again.

And even after activation, you will not receive interest for the period your refund was stuck.

That is real financial loss.

Higher TDS Can Hurt Your Cash Flow

One of the biggest impacts is higher TDS.

When PAN is inoperative, tax will be deducted at a higher rate.

This can mean:

More TDS on your salary

Higher TDS on bank interest

Higher TDS on professional income

Higher TCS on certain transactions

For salaried employees, this reduces monthly take-home pay.

For freelancers and professionals, it can create cash flow pressure.

How to Reactivate Your PAN

If your PAN becomes inoperative, you can reactivate it — but it is not automatic.

You must:

Link your Aadhaar with PAN

Pay a fee of Rs 1,000

Wait up to 30 days for activation

Only after that will refund processing restart and normal TDS rates apply.

The draft rules clearly define this 30-day activation window, leaving little room for confusion.

PAN and Aadhaar Now Fully Linked

The new draft rules also make Aadhaar central to PAN issuance.

If someone does not have a PAN but has Aadhaar, they can apply using Aadhaar details.

The tax department will verify Aadhaar before issuing PAN.

In short, Aadhaar is no longer just a supporting document. It is directly connected to PAN’s validity and functionality.

PAN is also required for many financial activities like opening demat accounts, applying for credit cards, and making certain high-value investments.

If your PAN is inoperative, these transactions may become complicated.

Why This Matters More Than Ever

The idea of inoperative PAN is not new. It existed under the earlier Income-tax Act, 1961 as well.

But the Draft Income-tax Rules, 2026 clearly define:

Refund blockage

No interest on delayed refunds

Higher TDS consequences

A fixed 30-day activation process

This structured approach makes the financial risks very clear.

Even a small delay in linking Aadhaar can lead to blocked refunds, higher deductions, and unnecessary stress.

The takeaway is simple: check your PAN status today. Under the new draft rules, ignoring it could cost you more than just paperwork.