How to Open Account in Central Bank Online: Friends, you must have heard about the Central Bank of India, it is a very well-known bank in India and many people prefer to open an account in this bank. The services of this bank are also very special. In such a situation, if you also want to know about opening an account in the Central Bank, then you have reached the right article.

An online account opening facility is available with the Central Bank of India. You can open an account in the Central Bank through your mobile or computer sitting at home. But most people do not know the correct procedure to open an online account. So here we are giving complete information about how to open account in Central Bank of India online. So let’s start.

Contents

- 1 How to open account in Central Bank online?

- 1.1 Step-1 Open centralbankofindia.co.in

- 1.2 Step-2 Select the Digital Banking option

- 1.3 Step-3 Choose an online savings account opening

- 1.4 Step-4 Select the New User option

- 1.5 Step-5 Accept Terms & Condition

- 1.6 Step-6 Fill out the Account Opening Application Form

- 1.7 Step-7 Select account service

- 1.8 Step-8 Save the TRN number

- 1.9 Step-9 Open account in Central Bank Online

- 2 How to open account in Central Bank by Visiting Branch?

- 3 Requirements to Open Account in Central Bank?

- 4 Facilities Available to Open Account in Central Bank

- 5 Frequently Asked Questions (FAQ’s)

- 6 Summary

How to open account in Central Bank online?

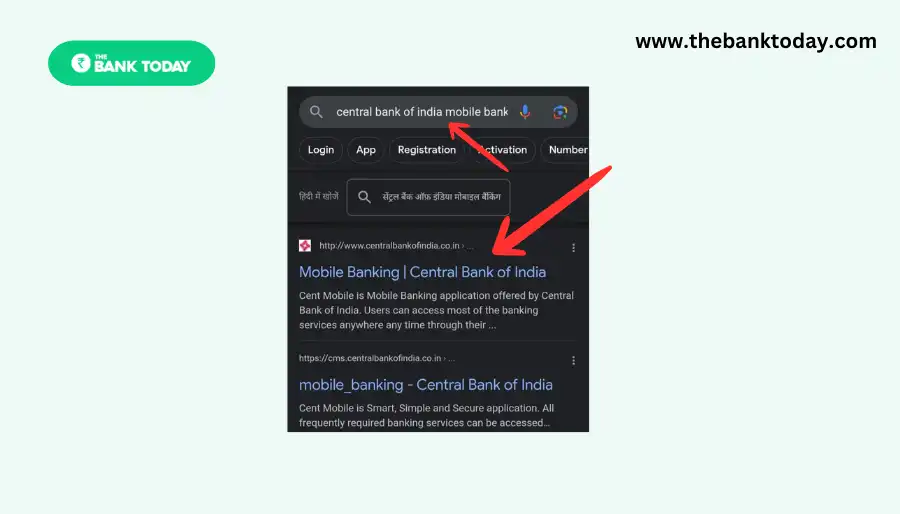

Step-1 Open centralbankofindia.co.in

First of all, you have to turn on your internet and open any browser on your mobile or computer. After that, you have to search by typing Central Bank of India mobile banking by clicking on the search option.

After that, you will see the website of Central Bank of India Mobile Banking at the top. You have to click on that website, from which you will reach the home page of the mobile banking website of the Central Bank of India. You can also go directly to the bank’s website through the link given here – Central Bank of India

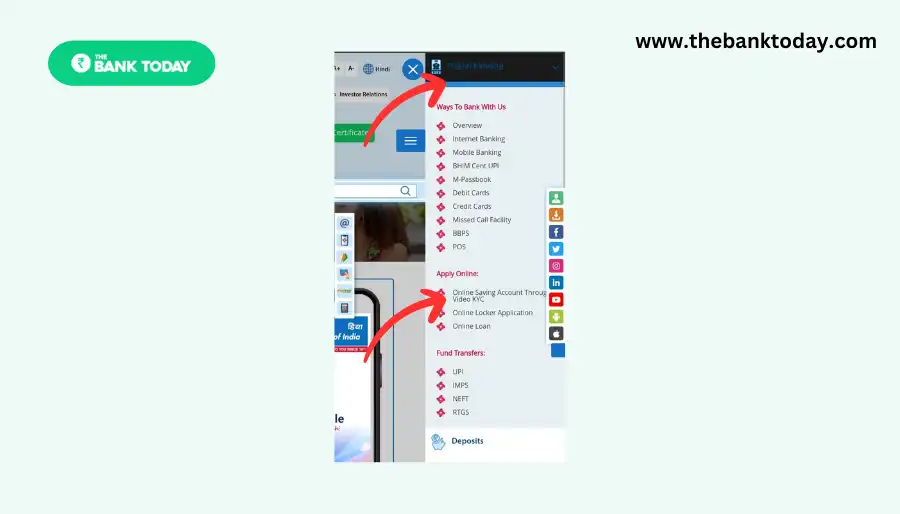

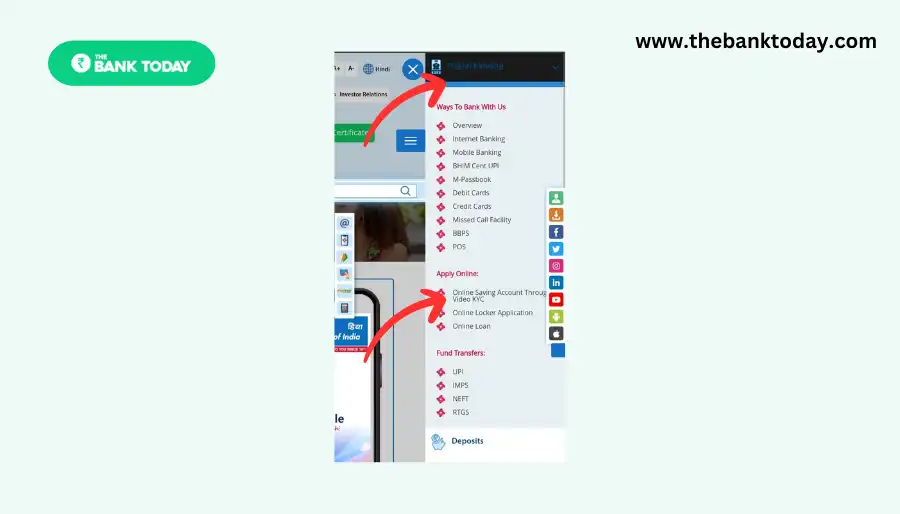

Step-2 Select the Digital Banking option

After that you will see three lines on the right side, you have to click on the three lines. After that you will see the Digital Banking option at the top. To open an account in the Central Bank, you have to select the option of Digital Banking.

Step-3 Choose an online savings account opening

Then you will see many options related to digital banking on the front screen. To open an account, you have to choose the option of online savings account opening.

Step-4 Select the New User option

After that, you will reach the next page, where you will see the option of the new user. To open an account, you have to select the option of New User.

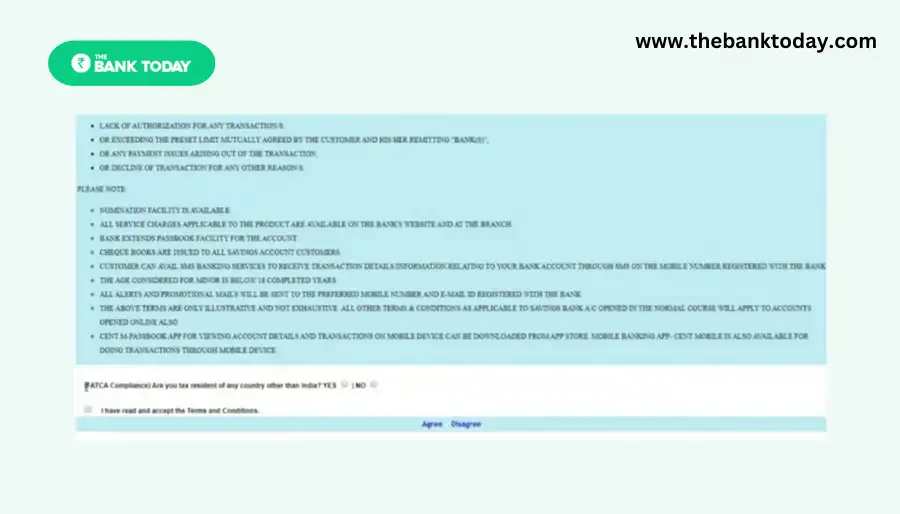

Step-5 Accept Terms & Condition

After clicking on New User, you will see the term and conditions related to opening an account in the Central Bank. You have to read them and select the Proceed button by clicking on the tick mark.

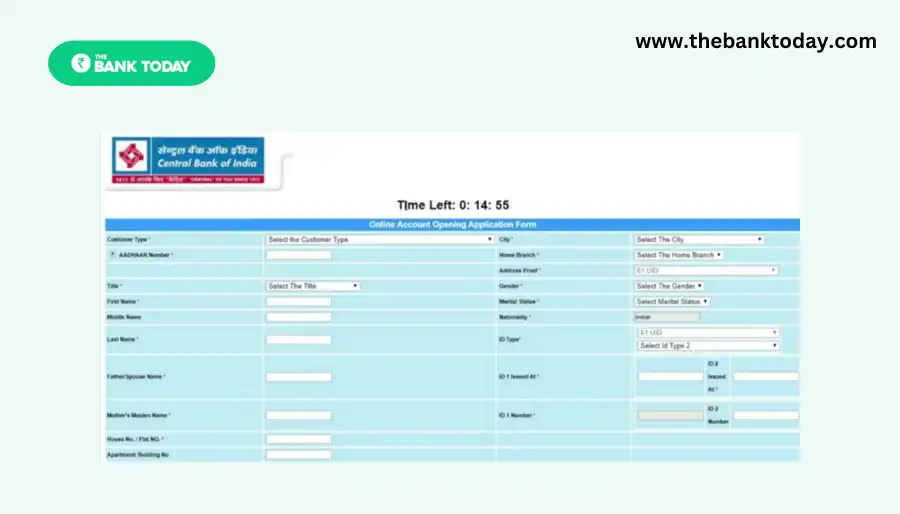

Step-6 Fill out the Account Opening Application Form

After that, the account opening form in the Central Bank of India will open in front of you. In that, you have to enter some basic information like your name, your Aadhaar card number, PAN card number, mobile number, details of your address, etc. Apart from this, you have to write the name of the branch of the Central Bank, in which you want to open your account, then you have to submit that name.

Step-7 Select account service

After that, select which services you want to avail from your bank account. Like if you want to get an ATM card, passbook, checkbook, etc., then select them and submit them. So that when you open a bank account, you get these facilities immediately along with it.

Step-8 Save the TRN number

After that, an OTP will come on the mobile number you have entered. You have to submit that OTP. After that, a TRN number will come to your mobile number. You have to save that TRN number.

Step-9 Open account in Central Bank Online

After that, you have to deposit one thousand rupees to complete the process of opening a bank account. Then your account will be ready to open. After that, you will get an account number, passbook, etc. After that, if you want, you can manage your Central Bank of India account by visiting the bank branch or sitting at home.

How to open account in Central Bank by Visiting Branch?

Friends, you must have known how you can open an online account in Central Bank. But if you prefer to open an offline account instead of opening an online account, then let me tell you that opening an offline account in Central Bank is also very easy. You can follow the process given below to open an offline account in Central Bank –

- First of all, you have to go to your nearest Central Bank branch with the documents mentioned above.

- After that, you have to take the new account opening form from the bank official.

- After that, you have to fill in that form properly, in which you have to enter your name, mobile number, and some basic details.

- After that, you have to attach the filled form and documents and submit it to the bank official.

- Apart from this, you will also have to deposit thousand rupees to the bank officer, after that the bank officer will open account in Central Bank of India and the thousand rupees given by you will be deposited in your bank account.

- In this way, you can easily open any type of account in the Central Bank of India offline.

Requirements to Open Account in Central Bank?

Friends, you would know that whenever you open an account in any bank, you need some important documents. Similarly, to open an account in the Central Bank, you will also need the following documents –

- Aadhaar Card of the applicant.

- PAN card of the applicant.

- Two passport-size photographs of the applicant.

- Address proof of the applicant.

- If the applicant is below 18 years of age, then he/she will also need the parent’s Aadhaar card and the signature of the mother or father.

- Applicants who want to take advantage of online banking should also have their mobile number and email ID.

Facilities Available to Open Account in Central Bank

Friends, you would know that every bank account has its own different facilities. In such a situation, if you want to open an account in the Central Bank, then you should know about the facilities available on opening an account in the Central Bank. If you open an account with the Central Bank, you will get a chance to take advantage of the following facilities –

- If you open account in Central Bank, then you also get the benefit of internet banking, through internet banking, you can take advantage of almost all types of services related to your bank account through your mobile sitting at home.

- Apart from this, people who have an account with the Central Bank can also get the benefit of the services of mobile banking.

- If you open an account with the Central Bank, you get an ATM card immediately.

- Those who have an account with the Central Bank can also take advantage of SMS banking.

- Apart from this, if you have an account with the Central Bank, then you can know the balance of your bank account through missed calls.

- If you have an account with the Central Bank, then you can also know the statement of your bank account through SMS.

- If you have an account with the Central Bank, then a locker facility is also available in some Central Bank branches, which you can easily take advantage of.

- Account holders of the Central Bank also get a chance to avail of the service of Fastag.

- Apart from this, helpline numbers have also been issued by the Central Bank for the customers, through which customers can easily find solutions to any of their problems.

Also Check: How to Check Account Balance in Central Bank Of India?

Frequently Asked Questions (FAQ’s)

With how many rupees the account is opened in the Central Bank?

Central Bank’s Savings Account opens with Rs.50/-. In this, the minimum deposit is Rs. 50/- will be. Other Central Bank accounts can be opened with Rs 1000. Apart from this, according to different accounts, different account opening amount is fixed.

Can I open a zero-balance account with Central Bank?

Yes, a zero-balance account can be opened in Central Bank. A savings account is available for this. There is no charge in this account even without money. You can open a zero-balance account in Central Bank. But the total deposit in this account should not exceed Rs.1,00,000/- in a year.

In how many days does the Central Bank account open?

If you open a Central Bank account online, then your account opens immediately. If you open the account through the form by going to the branch, then it may take 1-2 days.

Summary

Important information related to how to open account in Central Bank online, we have explained here in detail. We hope you have enjoyed this article today. If you have liked this article of today or are facing any problem opening the account, then you must tell us by commenting.

If you think that the information mentioned in this article can be useful to any other person, then definitely share this article on WhatsApp groups and your social media profiles. On this website, we provide complete information about simple and secure banking. If you want to get new and useful information like this first, then search in the Google search box – thebanktoday.com Thank you!