How to take a loan from Central Bank: Today home loans for the construction of houses, business loans for small businesses, and personal loans for other needs are available. Like other banks, the Central Bank also provides loans at very low-interest rates. But most people do not know what to do to take a loan from Central Bank.

Taking a loan from Central Bank of India is quite easy. For this facility to apply online and offline has been provided. But you have to fulfill the required criteria to avail of the loan. How to get a loan from Central Bank, let us provide you with complete information.

Contents

Brief Instructions

To take a loan from Central Bank, first, go to centralbankofindia.co.in. After this, select Apply for Retail / Agri Loan from the given option. Now submit your customer ID or Aadhaar number by filling it out. After this, fill out the application form for the loan and submit it online. You will get the loan after the bank official completes the verification and process.

The step-by-step details of taking a loan from Central Bank of India are given below with the help of screenshots. You read it carefully.

How to take a loan in Central Bank Online?

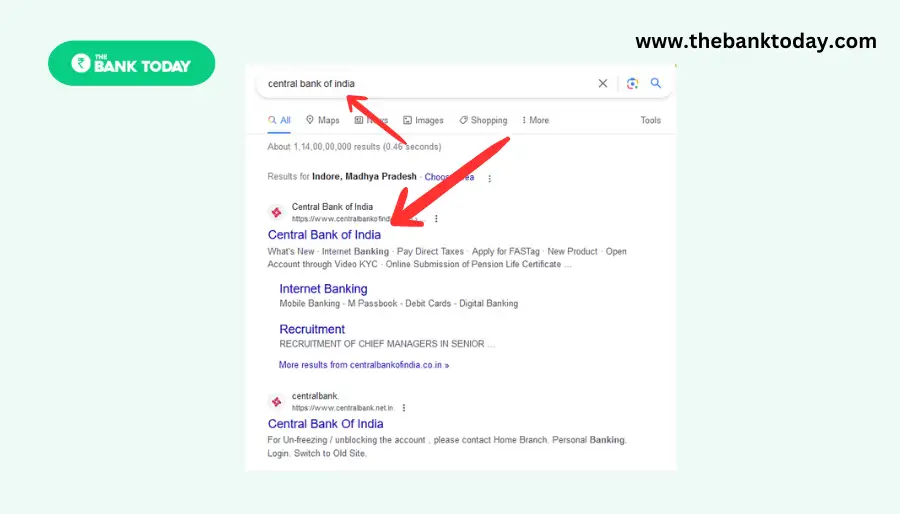

Step-1 Go to centralbankofindia.co.in

Friends, you will know that you can do many things related to this bank from the official website of the Central Bank. Similarly, applying for a loan online through the official website of the Central Bank is also very easy. First of all, you have to open any browser by turning on the internet on your mobile.

After that, you have to go to the website of the Central Bank of India. For this, search by typing Central Bank of India in the search box. You can also go directly to the official website through the link given here – the central bank of India

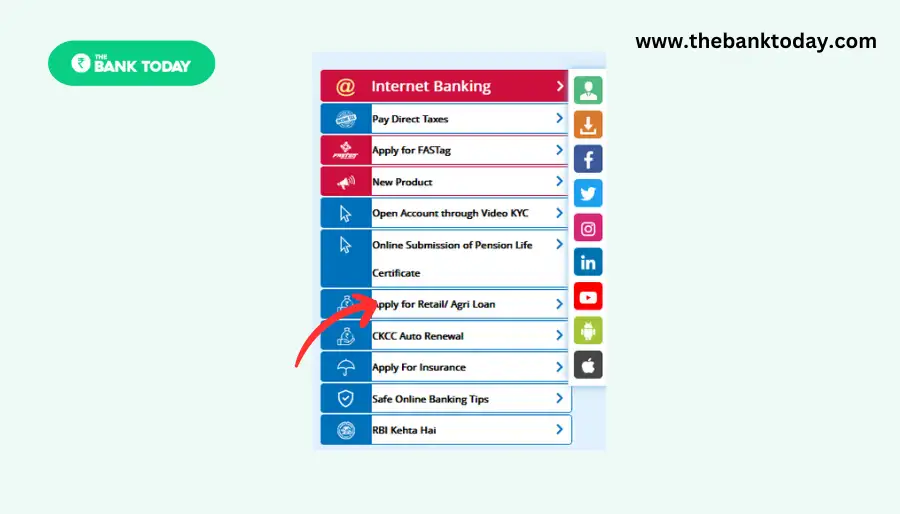

Step-2 Select Apply for Retail / Agri Loan

After opening the website of the Central Bank, different options related to banking will appear. In this, you will see the option of applying for a Retail / Agri loan in front. You have to select that option to avail the loan.

Step-3 Select the Retail Loan option

After selecting the option of Apply for Retail / Agri Loan, you will see the option of Retail Loan. You have to click on Retail Loan. Apart from this, if you want to take an agri loan, then under the retail loan, you will also see the option of an agri loan. You can take an agri loan by clicking on agri loan.

Step-4 Existing Central Bank Customer Select Yes or No

After that, you will be asked whether you are connected with the Central Bank or not. If you are connected with the Central Bank, then you have to enter your customer ID by clicking on the option of yes. Apart from this, if you do not have an account with Central Bank, then you have to enter the Aadhaar card number by clicking on the option of No and clicking on the option of Submit.

Step-5 Apply for a loan from Central Bank

After that, the form to apply for a loan from Central Bank will appear in front of you. You have to submit your name, mobile number, email ID, address, Aadhaar card number, etc. details in that form.

After that, you will get a call from the bank for verification. You have to answer the call which will complete the loan application. Then if you have entered all the details correctly and you have applied for the loan by following the term and conditions of the loan. So you will get loan approval and the loan amount will come directly to your bank account within a week.

How to apply offline for taking a loan from Central Bank?

- First of all, you have to complete the necessary documents and requirements.

- After that, you have to go to the nearest bank branch of the Central Bank of India with all the documents.

- After that, you have to meet the bank official and get the complete details of the loan.

- Then all your documents will be checked by the bank official.

- If all your documents and requirements are correct then you will be given a form to apply for the loan.

- You have to enter your name, address, ID proof, etc. information in that form and fill that form properly.

- After filling out the form, you have to attach some important documents and your photo along with the form and submit it to the bank official. You also have to keep in mind that you should not make too many mistakes in the form.

- After that, if all your documents etc. details are correct, and you get loan approval, then the loan money will come into your bank account.

Documents required to take a loan in Central Bank

Friends, if you want to take a loan from the Central Bank, then it is very important to have some documents with you. If you take a loan from the Central Bank, then you may need different documents according to different loan types. But the main documents you will need to take a loan from Central Bank are mentioned below –

- The person taking a loan from Central Bank should have two recent passport-size photographs.

- One thing from Aadhaar Card, PAN Card, Driving License, Passport, or Voter ID as proof of identity.

- One thing from Aadhaar Card, PAN Card, Driving License, Passport, or Voter ID as Address Proof.

- 3 months’ bank account statement, ITR, salary slip, or Form 16 as proof of income

Eligibility for taking a loan in Central Bank

Friends, you would know that if you want to take a loan through any medium, then you need to fulfill some eligibility criteria. Similarly, if you want to take a loan in the Central Bank, then you have to fulfill certain eligibility criteria.

- The applicant must be a citizen of India.

- The person who is applying for the loan should have a permanent service of up to 1 year in any government institution, school, hospital, or railway.

- The applicant should be serving in an Indian company or multinational company for 3 years.

Read Them:

- How to Open Account in Central Bank Online Free in 2023

- How to Check Account Balance of Central Bank of India free in 2023

Frequently Asked Questions (FAQ’s)

How much loan does the Central Bank give?

Loan up to Rs 10 lakh can be taken from Central Bank of India. But the thing to keep in mind is that only if you have a good credit score, you can get a loan of up to Rs 10 lakh. Apart from this, if you have already taken a loan, then you have got it fixed.

How much interest will be charged on taking a loan from the Central Bank?

If you want to take a loan from Central Bank, then the initial interest rate on the loan in the Central Bank is 7%. The loan interest rate in Central Bank also depends on how much money you are taking as a loan for how long. Keep in mind that the interest rate on the loan varies from time to time.

How long will it take to get the loan from Central Bank?

After applying for a loan from Central Bank, it can take up to 3-7 days for approval. Apart from this, if you apply online then it gets processed quickly. It will also depend on the information and documents provided by you at the time of getting the loan.

Conclusion

Know in detail how to take a loan in Central Bank. We hope that you have understood all the details about taking a loan from the Central Bank. If you have any other questions related to taking a loan, then you can ask in the comment box below. We will reply you very soon.

If you think that through this article any other person can also be helped in taking a loan in Central Bank, then you must share this article on your WhatsApp group. We provide complete information related to banking on this website. If you want to get new and useful information first, then search in the Google search box – thebanktoday.com Thank you!